|

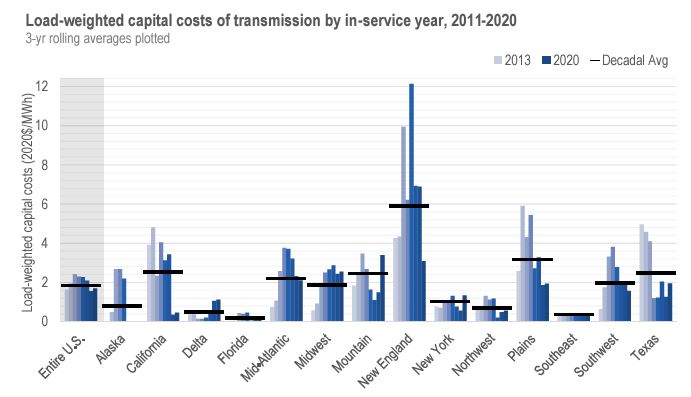

FERC’s Order 1920 Provides Transparency and Accountability for Longterm Planning Decisions By Andy Kowalczyk On May 13th, 2024, the Federal Energy Regulatory Commission (FERC) issued Order 1920 after hearing from a diverse array of stakeholders in the electric industry. From large electric utilities to small transmission-owning companies, power generation developers, consumer groups, industry experts, and state regulators responsible for approving electric transmission and power generation, FERC conducted a comprehensive survey of input leading to the final order. The final result acknowledges the necessity of long-term planning to maximize benefits and ensure consumers are not burdened with investments that do not benefit them. While FERC’s Order 1000 established the principle of ‘beneficiary pays’ for transmission projects qualifying for regional cost allocation, it did not specify which benefits were relevant to the project types paid for by beneficiaries. This omission left a significant gap for transmission planners who did not actively pursue multi-value or multi-benefit transmission planning. While planners like the Midcontinent Independent System Operator (MISO) and the Southwest Power Pool (SPP) have counted multiple benefits in the past using multi-value type planning - other regions like the Southeast have counted only the benefit of avoided local transmission investments. Even within MISO, southern member states have supported only a limited assessment of benefits for long-term transmission solutions that will be in service for at least 50 years. As a result, for the decade since Order 1000 was issued, U.S. transmission planning largely remained focused on short-term needs and limited benefits. This is crucial context when considering Order 1920’s requirement for transmission planners to consider seven benefit metrics when engaging in Long-Term Regional Transmission Planning (LTRTP). This final list of benefits, informed by comments from transmission planners and industry experts, aligns closely with the scope of LTRTP, assessing quantifiable changes to the bulk electricity system over the long term, in line with the average 50-year minimum that a transmission facility is in service. FERC’s 7 Benefits Explained Production cost savings A large benefit which is tracked in regional transmission planning efforts for most transmission planning regions (with the exception of those in the Southeast and Western regions of the U.S.) is the ability of new transmission to access lower cost options. This can manifest when transmission can access more affordable natural gas generation than coal, but it is especially prominent during our current era of energy transition when transmission can access lower cost wind and solar. Tracking this benefit is very important because it can help planners understand the most economic balance between transmission and generation investments, and how to maintain low prices for consumers. Avoided or deferred reliability transmission Local transmission investments cannot replace the need for longterm regional transmission solutions. Part of this is because of the short 5-10 year time horizon that these projects are focused on, but it is also because they often cover less physical distance than regional transmission. However, regional long term transmission can replace some local transmission solutions. This can be a smaller benefit, but nonetheless important to track. Reduced loss of load probability or reduced planning reserve margin Ever experienced a rolling blackout? There are a number of different ways it can happen, but not having access to power when the demand is high is a common culprit. There’s a tradeoff between building more generation, or transmission that can access more power generation capacity, and that’s an important benefit to consider. Order 1920 allows two options for this benefit - either count the reduction in loss of load, or blackout probability, or count the reduction in power generation reserves needed to avoid that outcome through the buildout of transmission that allows access to more regionally distributed power supply. Mitigation of extreme weather event impacts and unexpected system conditions There have been significant challenges to electric reliability due to the impacts of extreme weather events. Both extreme heat and cold can strain the grid and power plants beyond their capabilities, but there can also be systemic failures caused by parts of the grid failing. These are unexpected, or unpredictable contingencies, but they can be planned for, to ensure there’s a failsafe when they happen. As regional, long term transmission has a bigger impact footprint than more localized solutions, it’s important to consider the benefit they provide in mitigating the impacts of low probability, high impact extreme weather events, as well as unexpected system conditions that may arise across a larger footprint. Reduced transmission energy losses When focusing on regional transmission needs, the transmission solutions that are identified to solve long term needs on the bulk electric system are often those that can carry much more power over longer distances. Low voltage transmission is typically considered to be between 69 kV (69,000 volts) and 230 kV, and as power is carried at these voltages, there is a percentage of power lost along the way. The company American Electric Power provided data on this and found moving from 345kV - 500kV transmission resulted in a reduction from 4.2% losses to 1.3% respectively, with the highest losses at between 0.5-1.1% for 765kV lines. This is typically a small percentage, but over the long lifespan of a transmission investment, those losses can add up and so can the savings related to transporting more electricity with a new transmission solution that has a higher voltage. Capacity savings from reduced losses Just like there are energy savings from reduced transmission losses, there can be accumulated savings over the life of a long term transmission investment that can defer new investment in power generation. Decreased losses are a bit like an electricity piggy bank which over time saves so much in losses that it alleviates the need for new power generation investments. In other words, building long term regional transmission can mean that there are less gas power plants, solar or wind farms needed to keep the lights on. Reduced congestion due to transmission outages Transmission outages can happen for a number of reasons, but regionally planned transmission can alleviate their impact. By planning the transmission system longterm and regionally, transmission planners can build in optionality, which lowers the amount of traffic, or ‘congestion’ that the system experiences when having to redirect power flows due to transmission outages. Order 1920 requires long term regional transmission (LTRT) planning to consider transmission needs and benefits over a minimum 20-year time horizon, which is less than half of the average 50-year lifespan of transmission investments. SPP, which looks out 40 years in their Value of Transmission Report, exemplifies a more reasonable approach. SREA continues to urge MISO to adopt a 40-year planning horizon, especially for interregional planning between SPP and MISO. A mismatch in time horizons can lead to mismatched benefits between regions, hindering project approval.

Accurately accounting for all the benefits of long-term transmission investments ensures a complete picture of their value to state regulators responsible for approval. Ignoring relevant benefits can lead to costs eclipsing the benefits. Regulators need a full spectrum of benefits to understand what they are approving. MISO’s Multi-Value Project type, created in the late 2000s to integrate wind power in the Midwest, has demonstrated significant economic benefits exceeding costs, including resilience during 2021’s Winter Storm Uri. MISO President Clair Moeller stated that Multi-Value Project transmission lines, planned and approved over the last decade at a cost of around $6.5 billion, provided about $18 billion in benefits over three days of Winter Storm Uri. Planning for the worst system conditions is crucial, and Order 1920’s requirement for extreme weather sensitivities provides necessary insurance. These sensitivities ensure the grid can withstand dire circumstances and support better interregional planning by acknowledging low-probability, high-impact events. Both inside and outside of MISO’s footprint in the Southeast within the last 5 years, there have been marked challenges to the electricity system there. A system which is built almost entirely for short term needs within the utility territories there. This short sighted approach will need to adapt in coming years to extreme weather under Order 1920, which may provide an avenue towards better interregional planning as well. Having a larger pool of resources available across an area that may be larger than a storm impact is critical to reliability in the future, and by applying extreme weather sensitivities, planners can understand the benefits of ‘building a grid bigger than the weather.’ With Order 1920, transmission planning is changing for the better. In the coming year, transmission planners that have never engaged in LTRT planning will need to fill a very large policy gap when developing compliance plans, but that’s not the end of it. Transmission planning is iterative and needs to adapt to changes in state and federal regulations, power resource mix changes, demand, and other factors which FERC acknowledged in Order 1920. Revising forecasted scenarios is key to adaptation, and while FERC requires this happens every 5 years, SREA believes that it should be closer to every 3 years that scenarios are revised, consistent with the timeline that most utilities update their integrated resource plans (IRPs), which should include both generation and transmission. That being said, there is nothing in Order 1920 that stipulates transmission planners update scenarios sooner than every 5 years. Doing so would acknowledge the pace of change that the energy industry is experiencing. Solar and wind have declined dramatically in costs in recent years, and demand has increased for clean energy both from state climate policies as well as corporations seeking low cost options. Updating scenarios frequently can ensure that the transmission system is not under-serving of the demands of the future, and that a range of outcomes are planned for. For example, this year the Georgia Public Service Commission approved an updated IRP for Georgia Power Company within the standard 3-year IRP timeline to reflect updated load forecasts in light of an influx of customer demand in the state, including large data centers. It’s only natural that long-term transmission planning should be subject to timely updates to keep pace with changing utility plans related to demand and generation. If they don’t, it could lead to under-planning of the system which carries with it reliability challenges. Long-term planning is a lengthy journey, often taking 7-10 years from project identification to service. Order 1920’s concrete guidance on scenarios and benefits ensures that forward-thinking grid planning delivers the scenarios and benefits anticipated.

0 Comments

Last month, the Federal Energy Regulatory Commission (FERC) issued Order 1920, a groundbreaking rule that requires more comprehensive transmission planning across the country. This rule, developed over two years, marks a significant advancement in how the bulk electric system is planned.

Throughout its development, the Alabama Public Service Commission (PSC) was outspoken in its opposition to Order 1920’s reforms. The Alabama PSC’s latest filing reiterates many of its previous arguments, and states that Order 1920 is unnecessary, claiming, “Alabama has a resource planning process that accounts for needed transmission buildout to maintain reliable service.” The Alabama PSC contends that FERC’s new rule is meddling with states’ rights and “intruding on resources selection in Alabama.” The Commission contends that the “intrusion on resource selection is beyond FERC’s Authority”…“This includes the oversight of the [integrated resource planning] process and the associated selection of resources…” There’s one particularly notable problem with the Alabama PSC’s assertion: Alabama’s PSC does not have an integrated resource plan process. Referring to an IRP process, the Alabama PSC staff have stated, “The Commission has not adopted a formal standard; it has noted its ongoing knowledge of and involvement in Alabama Power’s IRP process.” Yet, even this “involvement” appears limited. According to Southern Company's 10-K filed with the SEC, “Certain of the traditional electric operating companies are required to file IRPs with their respective state PSC...”, but in Alabama, “Alabama Power provides an IRP report to the Alabama PSC.” (emphasis added) Alabama Power publishes a summary of its internal report approximately every three years, which is neither subject to approval nor review by the PSC, nor subject to any public comment or investigation. There is no docketed proceeding for Alabama Power’s IRP. There are no hearings, interventions, nor cross-examination. No expert witnesses are provided, and no parties can contest the IRP summary. While Alabama Power may have an IRP process, the PSC unambiguously does not. The latest IRP summary developed by Alabama Power was completed in late 2022, with no docketed proceeding at the Alabama PSC to review the document. Moreover, the Alabama PSC’s Rules of Practice expressly prohibit parties and members of the public from presenting arguments or evidence during its Monthly Commission Meetings. Without such a proceeding, and the corresponding opportunity for public participation and due process, Alabama Power effectively self-regulates its resource planning. Even if the PSC tacitly approves of Alabama Power’s self-regulation, the IRPs developed by the company are highly unreliable. For example, the 2022 summary indicates an addition of solar power only in the year 2041, showing a mere 570 megawatts of solar 20 years into the future. However, just a few months after the 2022 IRP was released, Alabama Power released a request for proposals for up to 2,000 megawatts of solar power, undercutting the IRP summary analysis provided. While generation planning and the siting and approval of transmission is reserved for the states, requirements for transmission planning fall under FERC’s jurisdiction under the Federal Power Act. The Alabama PSC’s complaint to FERC places a lot of weight on the Southeastern Regional Transmission Planning (SERTP) process, stating, “Transmission planning in Alabama (and in the SERTP process) already achieves many, if not most, of the goals in the Final Rule.” Alabama Power’s 2022 IRP summary briefly mentions the SERTP process with a copied description from previous dockets, lacking details on specific transmission plans or any comprehensive transmission planning process. But contrary to the Alabama PSC’s claims, the SERTP process has never resulted in any regional or interregional transmission construction across the geographic area it covers. Notably, no Alabama Public Service Commissioner has ever attended a SERTP meeting to date. FERC is aware of the Alabama PSC’s inconsistencies. In the final rule for Order 1920, FERC notes, “In response to Alabama Commission’s arguments that the…proposed rules have the potential to encroach on state-jurisdictional integrated resource planning and resource procurement processes overseen by Alabama Commission, SREA contends that Alabama Commission in fact does not have a formal integrated resource planning process upon which the [FERC] could encroach.” The states are still in charge under Order 1920. As noted in Order No. 1920, “states and other jurisdictional regulations will continue to have ultimate control over generation resource planning…regardless of what a regional transmission body proposes.” FERC Order 1920 does not make or otherwise mandate any state decision regarding generation planning or intrastate transmission planning. As further explained by FERC, “We disagree with certain commenters’ assertions that this final rule favors, promotes, or subsidizes particular types of generation resources over others, or otherwise engages in generation planning.” The Alabama PSC’s allegation that FERC Order No. 1920 is putting a “thumb on the scale” of resource planning Alabama via its regulation of Long-Range Transmission Facilities is misplaced. Alabama’s data gaps minimize the effectiveness of neighboring states to improve their systems and protect their ratepayers. Consequently, Florida, Georgia, Mississippi, and Tennessee’s transmission planning processes (to the extent they exist) cannot compensate for Alabama's deficiencies. Order 1920 is designed to fill the gaps created by only considering state-by-state transmission planning. While there may be reasonable arguments for improving Order 1920, let’s not pretend that Alabama has an IRP process that would alleviate the need for grid planning reform. Simon Mahan is the Executive Director of the Southern Renewable Energy Association. The electric industry in the United States has undergone a remarkable transformation over the past decade. In 2010, renewable energy accounted for only around 13% of electricity generation, with hydroelectric dams contributing the majority. Wind energy was on the rise but still trailed behind coal and natural gas, while solar power made up less than 1% of the energy mix nationwide. Fast forward to 2023, and approximately 14% of electricity was generated from wind and solar resources. Now, the Federal Energy Regulatory Commission (FERC), the top regulator of the U.S. bulk electric power system, is on the verge of implementing crucial reforms to grid planning that could significantly impact the reliability and affordability of our energy infrastructure. Depending on the final rule, a costly paradigm in grid planning could be avoided, and a more reliable and affordable energy future could be achieved. When FERC issued Order 1000, their last major grid planning reform to accommodate emerging growth in renewable energy, partially driven by public policy needs, it recognized that without planning ahead, there could be significant technical, and economic challenges associated with the transition to wind and solar resources from legacy coal and natural gas. In hindsight, many industry insiders feel that Order 1000 changed little in grid planning, and this has only increased the technical challenges in the current day. Forecasts from the Energy Information Administration, considered by many to be conservative, indicate a substantial increase in renewable energy generation over the next decade, surpassing the growth experienced in the past. Unlike previous shifts, the current transition to clean energy is driven not only by environmental considerations but also by economic factors such as decreasing costs and increasing consumer demand, as well as a desire for a more diverse fuel mix. In the Southeast, the cost of solar and energy storage has plummeted over the past decade, leading utilities like Southern Company and Tennessee Valley Authority to set clean energy goals for their territories. Additionally, corporate initiatives, such as Walmart’s drive to achieve zero emissions in global operations by 2040 is a major driver for procurement of clean energy in the region. State and local governments are also playing a significant role in driving clean energy adoption. North Carolina, for example, has passed legislation requiring utilities to achieve a 70% reduction in CO2 emissions by 2030, while the City of New Orleans has committed to transitioning to 100% clean energy by 2050. Moreover, there is a surge in renewable energy projects in Arkansas, Louisiana, Texas and Mississippi stretching the limits of the current grid, with 42GWs of clean energy requesting connection in 2024 alone. And much attention has been focused in recent years on Louisiana’s efforts to establish offshore wind resources in the Gulf of Mexico in the coming decade. However, the current electric transmission system, designed primarily for coal and natural gas power plants, is ill-suited to accommodate newer technologies like wind and solar, as well as emerging trends such as electrification and onshoring of manufacturing. The inefficiencies of the outdated grid planning paradigm are evident in the rising costs of maintaining the system. Yearly proposed transmission investments in the United States have reached $20 billion, with little consideration for the long-term challenges and changes in technology, demand, and energy sources. Regardless of how electricity is produced, we rely on the electric transmission system. This network consists of high voltage wires and substations that is analogous to an interstate highway system for electricity. The foresight is extremely limited with the investments made in this system that we are heavily reliant on. Transmission planners rarely look more than 5 years into the future when planning, which is roughly one tenth of the average 50-60 year lifespan of a transmission investment. During the lifespan of such an investment, power plants are decommissioned, new power resources begin operating, economic and population growth increases demand for electricity, and technology across many industries can change how all electricity consumers use energy. All these factors create technical challenges, that if not planned for with foresight, could lead to runaway costs in the future. Source: Edison Electric Institute Throughout the past few years FERC and state regulators have convened the Joint Federal-State Task Force on Electric Transmission to discuss many topics related to current and anticipated issues of grid reliability, affordability and the rising costs of transmission investments. Discussions with regulators, alongside a robust record of stakeholder comments have been distilled into a final rule expected from FERC this coming Monday May 13th. Many seasoned experts in the electric power industry expect it will create a sea change in how the grid is planned, and how investments are evaluated for their efficiency and cost effectiveness in addressing the challenges of the future. Nearly two years ago FERC issued their Notice of Proposed Rulemaking with an appropriately ambitious title ‘Building for the Future Through Electric Regional Transmission Planning and Cost Allocation and Generator Interconnection’. This proposed rulemaking covers a lot of ground, but the ambitions of FERC are matched to a moment where inefficiencies in the electric industry related to grid planning, who pays for the infrastructure that’s planned, and how new generation resources are connected to the grid are on track to increase consumer rates across the country. Transmission planning predominantly happens through utilities that develop yearly plans addressing short term reliability needs on their grids. Identified solutions can be fed into multi-state, or single state Regional Transmission Organizations (RTOs) that ensure these transmission solutions don’t harm other utilities’ grids. There’s 7 RTO’s across the country, and of those, only the Midcontinent Independent System Operator (MISO) and the Southwest Power Pool (SPP) have engaged in long term transmission planning beyond the 5 year planning horizon. In the Southeast, transmission planning has strictly followed this paradigm, both in the southern portion of MISO including Louisiana, Arkansas, Southeast Texas and Arkansas (MISO South), and in the Southeast Regional Transmission Planning (SERTP) group. There is a large record of comments on FERC’s proposed rulemaking from 2022 (300+) that come from a diversity of parties. State and federal regulators, consumer rights groups, renewable energy companies, grid planning entities, electric utility companies and public interest organizations all provided comments not just on the proposed rulemaking, but also on the inefficiencies of current transmission planning in meeting the incoming challenges. Given the amount of valuable perspectives and insights provided, these comments play a healthy role in informing FERC’s decision on what to include in the final rule, within the bounds of their legal jurisdiction. There are a few main themes that made it into FERC proposed rulemaking that may provide insight into the final rule:

Unequal Outcomes As mentioned, at least one transmission planner in the U.S. has been at the forefront of the kind of scenario based, multi-value transmission planning that FERC seeks to require through their expected order. MISO completed their Multi-Value Project effort in 2011, resulting in 17 regional transmission projects over 11 states in the north midwest, delivering up to $3B in benefits for every $1B spent on the total portfolio. Very recently, MISO completed ‘Tranche 1’ of their Long Range Transmission Plan (LRTP) again in the north midwest, resulting in 18 regional transmission projects over 11 states, delivering $2.6B in benefits for every $1B spent on the total portfolio. Tranche 1 is only the first part of a four phase effort for MISO to prepare the grid they oversee for a multitude of expected changes they have forecasted across a set of 3 probable scenarios. Currently MISO, state regulators from states they cover and a diverse array of stakeholders are engaged in discussions about ‘Tranche 2’ of the effort, again in the north midwest, and MISO expects to finish this effort in September of 2024. Source: MISO MTEP21 Report Addendum: Long Range Transmission Planning Tranche 1 Executive Summary

Only half of MISO’s 15 state footprint stretching from North Dakota to Louisiana has been engaged in any kind of long term regional planning. Tranche 3 of MISO’s LRTP planning effort is slated to begin after the conclusion of Tranche 2, but the success of that effort hinges on Louisiana, the City of New Orleans, Texas, Arkansas and Mississippi to come to an agreement on cost allocation, likely with the rest of MISO’s 15 state footprint. There has never even been a planning effort of the scale of MISO’s MVP or LRTP in MISO South. Historically, transmission planning more closely resembles what happens in the non-RTO SERTP regions yearly planning efforts to the east of MISO South. In the SERTP region, electric utilities plan for near term needs, 5 years into the future, consider only the benefit of one transmission project in alleviating another, and do not consider long term changes in the generation resource mix or demand. This is a problem, considering that projected growth in the region has become quite sizable and consumers largely want clean energy to fulfill that demand. That challenges fulfilling demand can change during the extreme weather events like recent Winter Storm Elliott, is another consideration. Building regionally has the potential to unlock resources outside of storm impacted areas, but planning like this is not considered currently in SERTP. Put simply, a grid planned in a piecemeal fashion has led to an over dependence on in-state generation planning decisions that may force a dependence on power plants that fail during extreme weather. The challenges are great, but planning ahead, and doing so in a thoughtful manner is key to success. Hopefully the final rule issued by FERC supports best practices engaged in by grid planners like MISO that think long term and comprehensively about the needs of the future. In regions like the Southeast, where long-term regional planning has been absent, these reforms have the potential to catalyze the transition to ensure a reliable and affordable energy future regardless of preference for clean energy. By fostering collaboration among states, utilities, and other stakeholders, FERC's final rule could play an essential role in planning for a more resilient and efficient grid in the region, that meets the needs of the 21st century. It’s likely you may have heard by now one way or another - the electric power grid is having a moment. There have been countless stories in the media recently that have pointed out the need to build out a grid that meets the reliability challenges of the 21st Century. There’s good news, but unfortunately there's a lot of bad news too. The most prominent story heard lately is that our grid lacks the ability to deliver power when and where it’s needed during extreme weather conditions. Multi-day heat waves and cold weather storms have challenged both the power plants and the grid that we depend on in recent years. It’s something that SREA has been laser focused on in recent years, because an inadequate power grid, that can’t meet the challenges of extreme weather, is also a grid that cannot provide reliable power from renewable energy or battery storage devices.

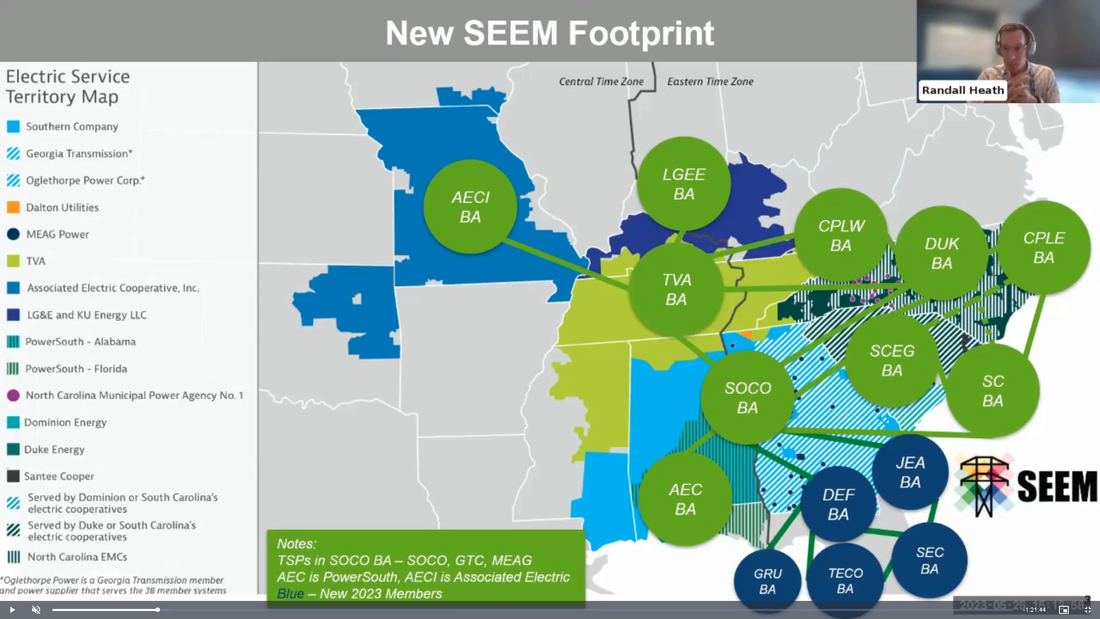

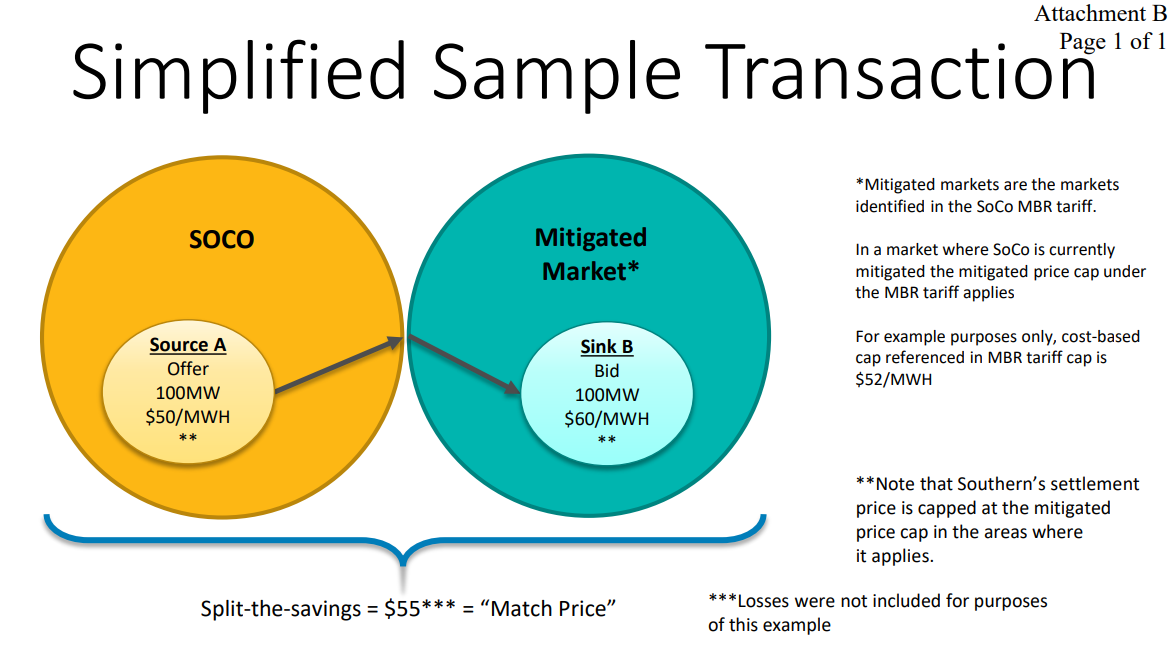

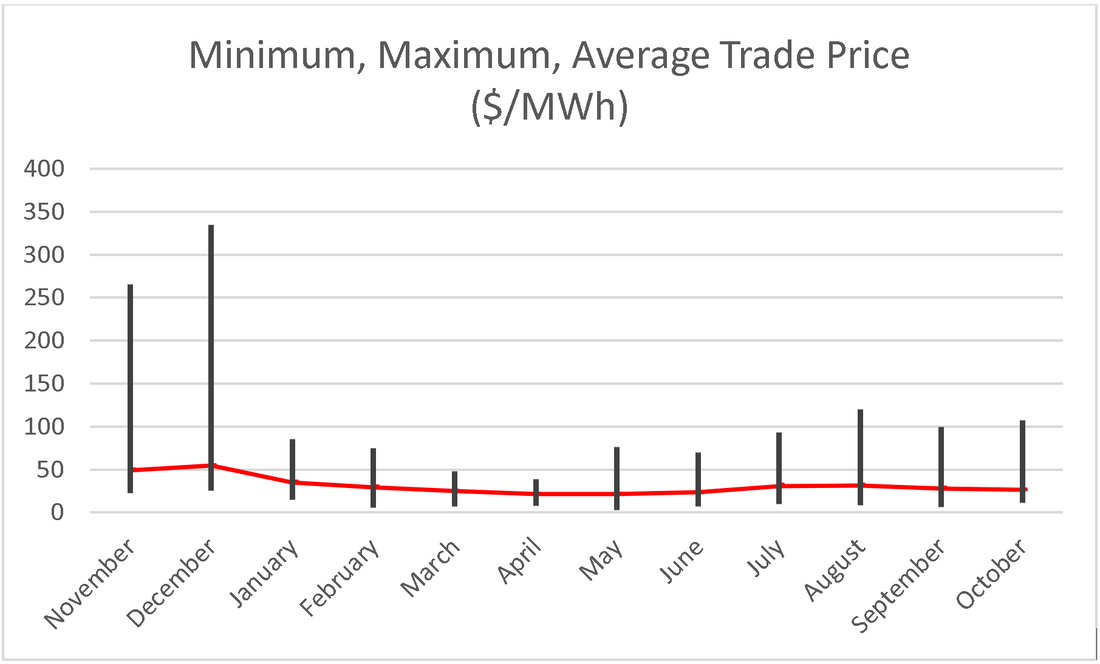

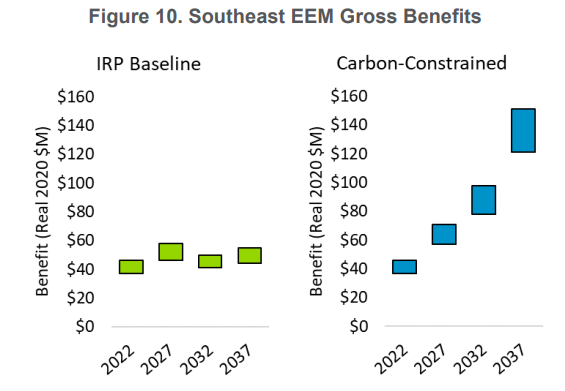

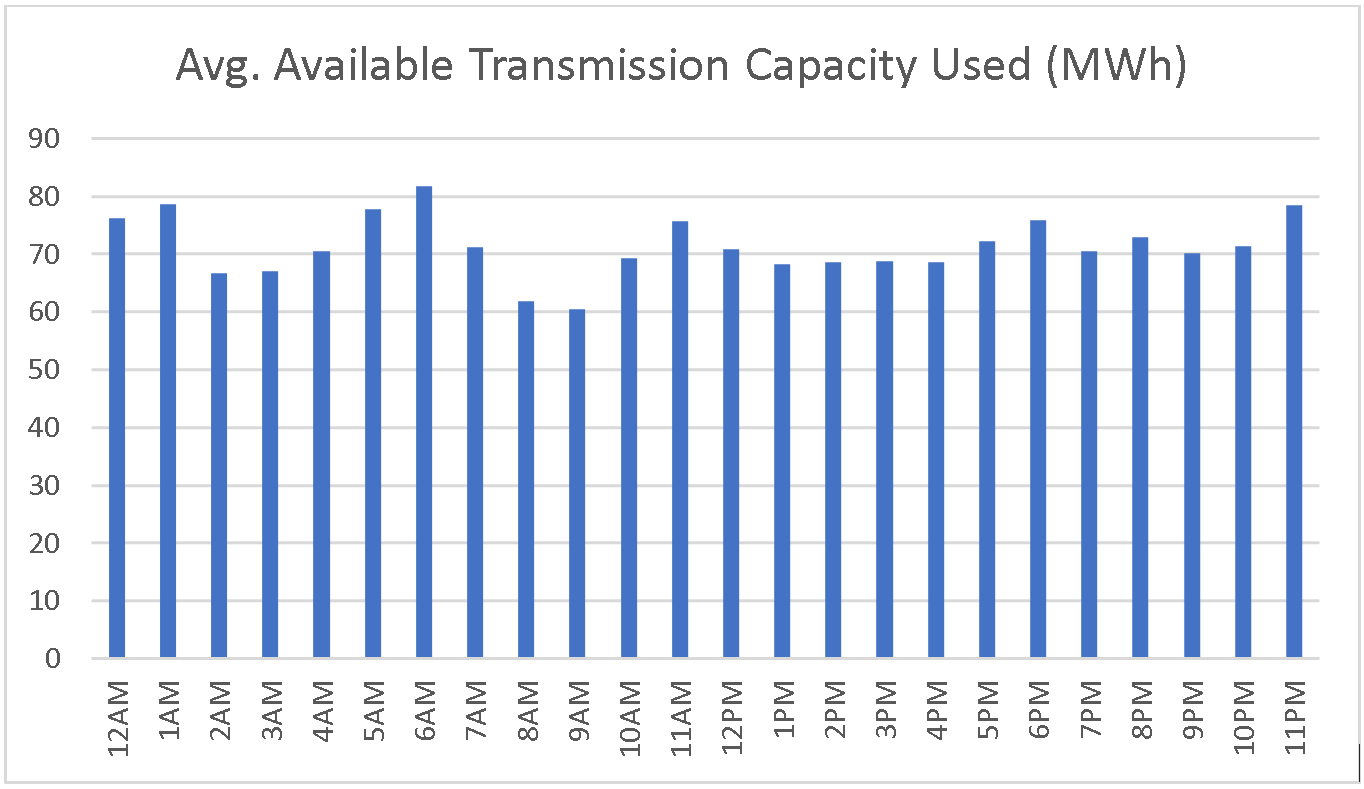

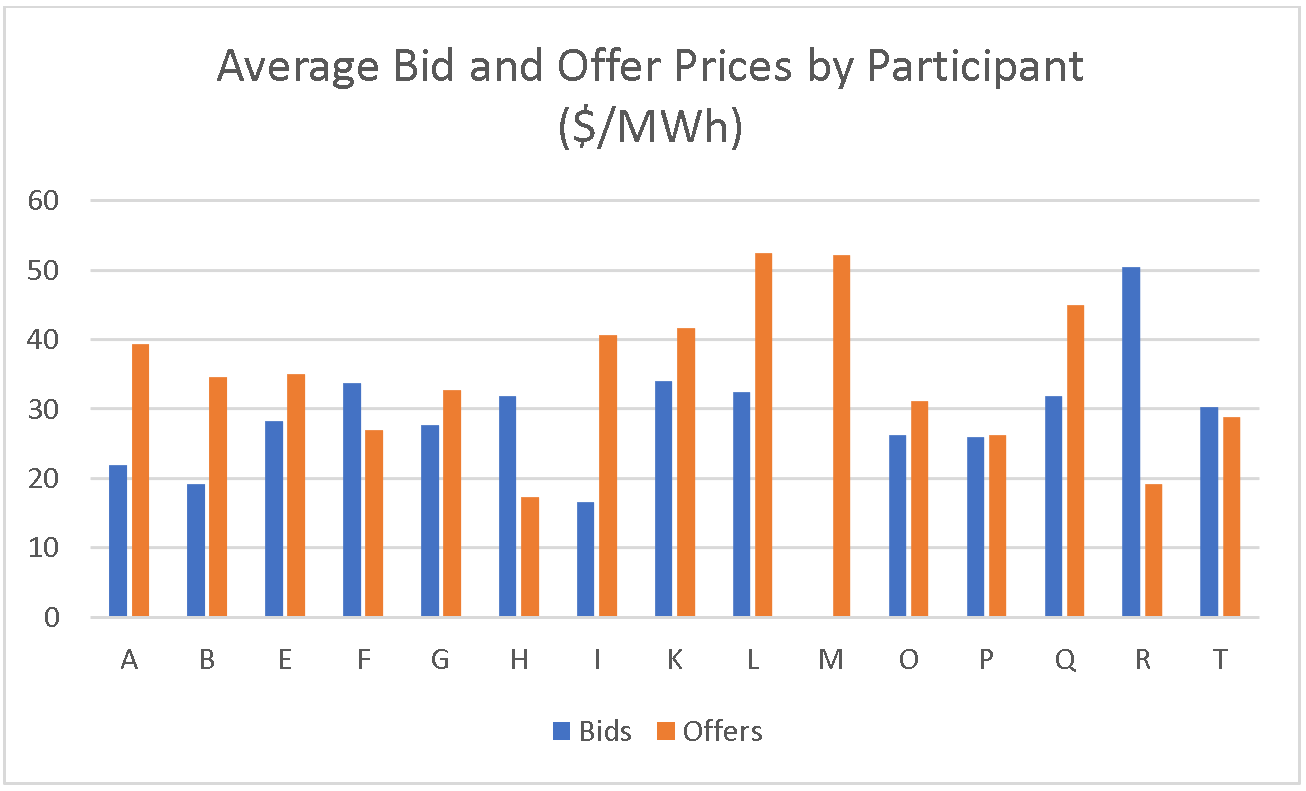

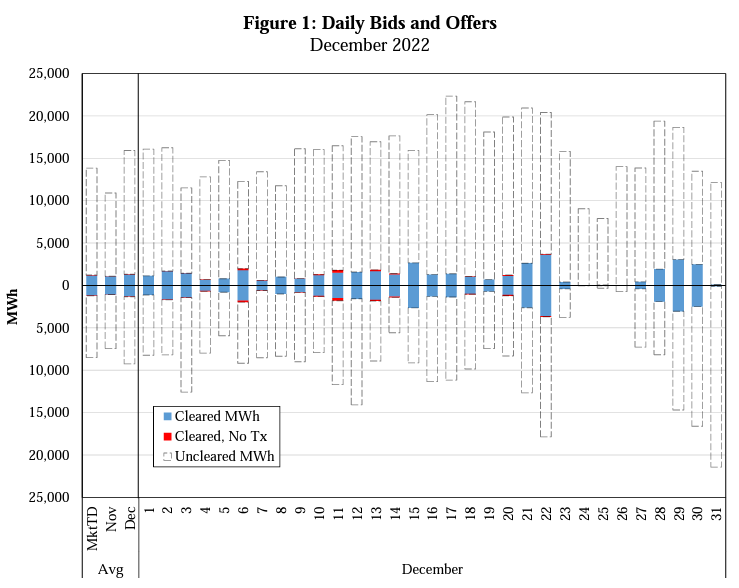

Considering this very weighty topic, our organization recently partnered with The Pew Charitable Trusts to discuss transmission planning with decision makers at a ‘Transmission Luncheon’ held at the Sheraton Hotel in New Orleans, Louisiana on March 4th. Our discussions included meetings with state regulators, staff, renewable energy developers, representatives from the grid planning entity known as the Midcontinent Independent System Operator (MISO), and other stakeholders who follow this issue closely. The discussion centered not only around known challenges, but also, most importantly, solutions to the myriad challenges associated with planning a grid that serves the needs of the 21st century. What are these challenges and opportunities? None other than the Federal Energy Regulatory Commission (FERC) has been grappling with this question recently in a landmark proposed rulemaking titled ‘Building for the Future Through Electric Regional Transmission Planning and Cost Allocation and Generator Interconnection’. FERC is the federal government agency charged with the mission of ensuring ‘just and reasonable’ electric rates for electric utility customers across the country. This entails oversight of the multi-state electric transmission system spanning the country, with exception of most of Texas. In their proposed rule issued in April of 2022, they outlined a host of issues that threaten the affordability and reliability of the electric grid, and proposed remedies. Amongst these are: planning for a grid that is far different from our legacy fossil fueled one, ensuring that planning utilitizes forecasts that assesses power generation and demand far into the future, and acknowledging the full benefits of grid investments so that decision makers charged with approving siting and constructions of the grid are equipped with a clear picture of their value. In MISO’s case, they have been at the forefront of implementing the types of reforms described in FERC’s proposed rulemaking since launching an effort called the Long Range Transmission Plan (LRTP) in late 2020. LRTP is an effort that incorporates many of the ‘factors’ in FERC’s proposal like changes in the energy resource mix, retirement of resources driven by federal and state law as well as nonbinding targets, increases in energy demand, fuel and technology costs linked to energy resources, as well as utility and corporate goals. Additionally MISO adopted an assessment of transmission needs incorporating these factors over a 20 year time period for LRTP. While many in the electric industry are awaiting a forthcoming final rule from FERC, which utilities and transmission planning entities across the country will need to comply with, MISO is already hard at work on ‘Tranche 2’, their second portfolio of LRTP transmission solutions in the northern portion of the footprint. This second iteration is the prelude to planning an LRTP ‘Tranche 3’ in MISO South. SREA’s work with The Pew Charitable Trusts and other stakeholders this year have focused on supporting moving forward with more proactive transmission planning in our region.Potential changes in the energy resource mix became a major story in 2022, in the MISO South area comprising parts of Arkansas, Louisiana, Mississippi and Southeast Texas. In that year alone 70.1GW’s of solar, wind, energy storage and hybrid solar/energy storage resources entered into MISO’s yearly interconnection queue, requesting study for interconnection to their grid. To put this into perspective, MISO South’s record demand was 32.6GW’s during Winter Storm Heather this past January, less than half that amount. In just one year there was enough clean energy awaiting interconnection to the grid, and there are many renewable energy, energy storage, and high voltage transmission projects from previous queue years awaiting interconnection in MISO. On the face of it, this seems like tremendous news for MISO South, but the lack of large-scale regional transmission planning like that undertaken in MISO North has resulted in unequal outcomes and costly grid upgrades of up to $100M per project needed in order to connect these resources. As a result, many of these requests could be withdrawn by renewable energy developers because the cost of upgrading the grid in a piecemeal fashion is much more costly in the absence of large regional transmission supports. While both FERC and MISO have weighed in on interconnection reforms recently, there remains tension between developers and grid planners over costs and their responsibility for proactive grid planning. This theme of who pays, and whether developers already struggling to break even on clean energy projects should be in charge of paying for large regional transmission is at the heart of discussions currently underway in MISO South. Since there are many benefits considered in MISO’s LRTP process, singling out developers as a monolithic group, devoid of who specifically may benefit, continues to be a point of contention. Also, whether states or jurisdictions with clean energy goals like the City of New Orleans should have to pay more for regional transmission simply because these upgrades will provide a more stable grid for clean energy resources to connect to. Over our discussions, if there was one common theme that rose above all else, it was that it takes a village to plan for the grid of the future. There is a common sentiment amongst stakeholders that open dialogue between grid planners, stakeholders and decision makers was crucial in developing a cost efficient grid plan that incorporates the assessment of the full potential of large transmission investments to solve multi-state energy issues. With not only a final FERC planning rule expected in coming months, but also Tranche 3 of LRTP in MISO South, this kind of dialogue will be crucial in planning a grid for the 21st century. Gridlocked: Planning Failure with the Southeastern Regional Transmission Planning Process12/20/2023 The Southeastern Regional Transmission Planning (SERTP) process is run by some of the largest utilities in the southeast, including Duke Energy, Southern Company, Tennessee Valley Authority and others. For the past decade, SERTP has failed to provide any real regional transmission planning solutions. SERTP was never intended to be a true planning process and is riddled with flaws. SERTP officially began in 2013 as an effort for the non-organized southeast to comply with the Federal Energy Regulatory Commission's newly minted Order 1000, which required improved regional transmission planning between utilities. The Department of Energy's latest National Transmission Needs Study found that the Southeast will need to expand its transmission capacity by 77% by 2035; however, even with the implementation of FERC Order 1000, this past decade has resulted in some of the lowest levels of investment in the Southeast compared to other regions around the country. An impediment described in the DOE report includes the lack of transparent locational energy pricing: "...information on the economic value of congestion outside RTOs/ISOs is minimal when compared with the market price differential data available from RTOs/ISOs..." As a result, "The Delta, Southeast, and Florida regions installed the fewest circuit-miles, relative to regional load, throughout the decade." Why does transparent locational energy pricing matter for transmission planning? In other regions, clear energy price differentials enable transmission planners to identify valuable transmission projects that would reduce overall system costs. Without energy pricing data, utilities in the south are effectively blindly managing generation dispatch to maintain system reliability, without consideration of ratepayer costs. There's always a cost, even if it's not accounted for. This year, SREA worked with other stakeholders in the SERTP Regional Planning Stakeholders Group (RPSG) to develop four out of the five scopes of work for the "Economic Planning Study" process. SERTP is a transmission planning process entirely run by the utilities, and we were appreciative for the opportunity to develop several studies. The process works like this: identify a source (usually a full balancing authority area), an amount of megawatts to move (this is non-resource specific, so the models don't know if the new megawatts are solar or coal), and a sink where the power is moved to (again, another balancing area). Plug those data into the models, and the models help identify problems on the grid that need to be resolved. Based on some significant transmission constraints in Northern Georgia that were described by Georgia Power Company in their 2022 IRP, we evaluated moving 1.6 GW (in our view, solar projects) from Southern Georgia to Northern Georgia, and another scenario that looked for the same amount from TVA into North Georgia. The results were quite good. The SERTP utilities estimate $96 million in upgrades to move 1.6 GW of power from the South to the North of Georgia, and just $56.5 million to move that amount of power from TVA. Several of the transmission constraints (thermal loadings) are already exceeding 100% even without the requested new power flows (the Charleston-Hiwassee River 161 kV line is already at 108.7% thermal loading without any changes), indicating TVA's system is already stressed and the costs associated with the study results are not necessarily driven by the new power flows represented in the RPSG studies. When considering that transmission substations can easily cost tens of millions of dollars, these results are stunningly good. Speaking of TVA, we requested an evaluation of moving 2.9 GW of power from Arkansas (MISO South) into Memphis. A few years ago, Memphis Light Gas & Water evaluated leaving TVA and joining MISO. For MLGW, it would have necessitated building or contracting with about 2.9 GW of new generation resources in Arkansas. At the time, MLGW estimated the new transmission costs would have been close to $376 million. While MLGW paused its efforts to evaluate MISO membership, the SERTP results suggest TVA could easily bring in 2.9 GW of power for $21.5 million - about 94% less cost than MLGW calculated. Given TVA's recent blackouts during Winter Storm Elliott, the company ought to seriously consider these minor transmission upgrades. Finally, SERTP evaluated importing 1,242 MW of power from MISO North into Louisville Gas & Electric/Kentucky Utilities (LGEKU). That analysis was based on LGEKU's recent requests to the Kentucky Public Service Commission to replace some existing coal-fired power plants with new natural gas units. The company did not consider MISO imports as an alternative; however, in the SERTP process, we were able to evaluate potential transmission limitations. Again, the SERTP analysis found it would be relatively low cost to upgrade the transmission system and enable the power flows: just $83.5 million. Will any of these transmission projects get built? It all comes down to benefit metrics: how do transmission planners view the value of transmission compared to the costs? SERTP is Ineffective While the SERTP analysis results were quite positive, the extent of SERTP's usefulness ends with the study results. Stakeholders were shocked to learn that the SERTP utilities evaluate no benefit metrics for the potential projects identified. Thus, the "Economic Planning Studies" truly evaluate no economic component of transmission planning, nor do the studies incorporate even the most basic values of transmission. None of the transmission identified is guaranteed to be in the utilities' actual transmission plans. There is a process where SERTP utilities can evaluate a benefit of transmission. SERTP, by its tariff rules, is only allowed to evaluate a single benefit metric: avoided transmission. If the SERTP utilities find a transmission project that they like in the SERTP process, they would evaluate any savings associated with cancelling potentially smaller planned projects nearby. By replacing smaller transmission projects with a more robustly planned project, the utilities would theoretically reduce costs and build the new line. But there are a few problems with this theory. First, SERTP only evaluates 10 years’ worth of benefits from the time the study begins. Thus, if a study begins in 2024, the analysis will only stretch out to 2034/2035. SERTP utilities often insert the new transmission assumptions perhaps 5-9 years into the process, meaning that potentially only a few years of transmission benefits are calculated. Put another way, if a transmission project gets added in the 9th year of a 10-year model, only 1-year of benefits are measured, even though transmission projects can easily last 40-60 years and provide numerous benefits during that time. The time horizon is unreasonably short. Next, many utilities may have 10-year transmission plans; however, those same plans are typically most accurate for the first five years, with the later years not fully vetted. In this case, a transmission project is only evaluated after year 7 or 8 in the model, but the utilities' internal plans effectively only go to year 5. Therefore, no transmission would be avoided by the new proposed line. There are no benefits to measure. SERTP's shell-game has never led to new transmission being built. This year, the SERTP utilities opted to not even bother to perform this additional analysis. It's no wonder why the SERTP process has never led to any regional or interregional transmission development. The process was designed to fail from the beginning. SERTP Isn't Accurate Transmission planning incorporates two fundamental data sets: generation and load (power demand). By modeling where new generation will be installed, or older generation will be retired, in addition to any load growth or decline, transmission planners are meant to find any potential reliability problems caused by the ever-changing system. Once the problems are identified, solutions can be built. In SERTP, the participating utilities share data with neighboring utilities - a sort of data swap to ensure that one utility's plans aren't going to negatively affect someone else’s in the footprint. If utilities aren't sharing accurate data, transmission modeling will not be able to identify potential problems ahead of time. Recently, LGEKU received approvals from the Kentucky Public Service Commission to retire nearly 600 MW of coal, build a 640 MW of new natural gas capacity, as well as build nearly 800 MW of solar plus 125 MW/500 MWh of battery storage. In essence, LGEKU is undergoing some pretty dramatic changes over the next few years. However, LGEKU representatives told their SERTP neighbors that the utility expects no "change throughout the ten-year planning horizon for the 2024 SERTP Process." (slide 188). When asked about this discrepancy, LGEKU representatives stated that the solar facilities had not yet received their Generation Interconnection Agreements, despite being approved by the PSC, and so the company (using their own internal "best practices"), decided to not include those changes. By the way, LGEKU is in charge of its own generation interconnection process and approvals, so any delays are caused by the company itself. Duke Energy in the Carolinas performs a different type of analytical gymnastics. The company there knows it wants to retire some existing generation resources, like Cliffside 5, Marshall 1 & 2, Roxboro and Mayo. When transmission planners remove electric generation in the models, the entire system responds to those retirements by ramping up generation elsewhere. This change in the power flow can result in transmission constraints: problems that need to be solved. Instead of letting the models work, Duke inputs "proxy" generators into the model to make up for the retirements. Duke explains that through this process, "Generators [are] left in [the] model in expectation of replacement generation through the Generation Replacement Request process." In other words, the model is told there is no retirement and are unable to identify if any problems would arise from the retirements. This is a form of hardwiring power plants into the model. By hardwiring “no change” into the models, it biases transmission planning towards the status quo and increases the likelihood that a utility will install a natural gas unit. Observant readers would note here that Duke has not received state regulatory approvals to replace those specific units at those specific sites and includes the changes anyway, while LGEKU has received approvals but does not include the changes in their models. When asked about the discrepancy in which units to include versus exclude, the SERTP utilities explained that each utility comes up with their own methods of data reporting. The individual utility methodologies are not consistent. This "best practice" method evidently also extends to load growth projections as well, meaning state integrated resource plans (which include both generation and load assumptions) are not necessarily included in the SERTP process. Perhaps the most egregious lack of data transparency and transfer in SERTP is with the Tennessee Valley Authority. Like LGEKU, TVA reported to its SERTP neighbors that the company expects no changes over the next decade (slide 261). In May 2023, TVA CEO Jeff Lyash told his board of directors that after a successful competitive solicitation, the company plans to sign contracts for 6,000 megawatts of clean energy resources from 40 solar farms. Those contracts would go a long way to meeting TVA's own goal of adding 10,000 megawatts of solar by 2035. Meanwhile, TVA told the North American Electric Reliability Corporation (NERC) that the company will "add 7,251 MW of natural gas generation and retire 5,159 MW of coal generation over the period. A total of 3,937 MW of [Bulk Electric System]-connected Tier 1 solar PV projects are expected in the next 10 years." TVA is telling its Board of Directors (its regulators), NERC, and SERTP utilities three different stories over the next ten years. When asked about these discrepancies, SERTP utilities explained that each utility comes up with its own methodologies for sharing data, or not. There are no rules regarding what gets included, or not. SERTP Ignores Public Policy As part of the SERTP process, stakeholders are allowed to ask that the utilities include a public policy scenario. Stakeholders are required to file their scenario request 60 days after the Q4 meeting, usually about a month before the Q1 meeting the following year. In 2023, three public policy requests were filed by stakeholders regarding North Carolina's Carbon Plan, a legally binding state public policy. At the Q1 2023 meeting, stakeholders were told that the SERTP utilities were still "evaluating" these requests and would provide an update at the next meeting. At the Q2 2023 meeting, SERTP utilities explained that they would not be performing a public policy analysis because, "SERTP itself has no role in the North Carolina local transmission planning process." In effect, the SERTP utilities have eliminated any state public policy for future discussions. In its order adopting the Carbon Plan, the North Carolina Utilities Commission stated that, "Furthermore, based upon the potential magnitude of future transmission expenditures, the Commission urges Duke to explore all possible efficiencies and to be vigilant in its participation in SERTP and in its coordination with PJM to assure a least cost path to achieve the carbon dioxide emissions reduction requirements while maintaining and improving reliability." Evidently Duke can unilaterally ignore its regulators, and the SERTP public policy process, and stakeholders have no recourse. To date, roughly a decade after FERC Order 1000 outlined a role for including state public policy in transmission planning, SERTP has never modeled a public policy scenario. Fixing SERTP SERTP exists because of FERC Order 1000, requiring regional coordination in transmission planning. In recent years, FERC has again taken up the prospect of developing a more holistic regional planning effort. FERC's proposed regional transmission planning rule, if applied to non-RTO regions like the southeast, would greatly improve SERTP's planning process. The planning rule borrows some of the (true) best practices of other regions by requiring multi-scenario, multi-value (benefits) analysis. Unsurprisingly, utilities in the southeast opposed FERC's proposed transmission planning rules, arguing in part that because the states do IRPs and SERTP works fine, FERC should not impose the transmission rule on the southeast. SREA's comments to FERC call into question the validity of the IRPs and SERTP. Given that even IRPs are not directly included in SERTP (nor public policies, nor some state approved contracts), it appears that the SERTP utilities had not been entirely straightforward with FERC. The SERTP utilities also told the Department of Energy to ignore the region. The utilities told the DOE Transmission Needs Study team that, “SERTP Sponsors also disagree with the Study’s claims that the Southeast will need a lot more transmission capacity in the future, as it does not have enough evidence to support this assertion. SERTP Sponsors claim that the Southeast already has a strong transmission system and has been investing in it to meet the needs of customers and to accommodate state energy policies.” However, the DOE Needs Study found that the Southeast has been one of the lagging regions in transmission development in the country. While a new FERC transmission planning rule that applies to the southeast would be exceptionally helpful, the rule only applies to a few utilities in the southeast. Duke, LGEKU, OVEC, and Southern Companies are considered the "Jurisdictional SERTP Sponsors", while Associated Electric Cooperative Inc. (“AECI”), Dalton Utilities (“Dalton”), Georgia Transmission Corporation (“GTC”), the Municipal Electric Authority of Georgia (“MEAG”), PowerSouth Energy Cooperative (“PowerSouth”), and the Tennessee Valley Authority (“TVA”) are all non-jurisdictional utilities. Those utilities participate in SERTP voluntarily and are outside FERC’s jurisidiction. For utilities like TVA, their board of directors would need to get serious about their job as regulators and require TVA to engage in SERTP earnestly. Alternatively, the United States Congress could amend the TVA Act of 1935 and require that TVA become FERC-jurisdictional. Absent FERC or congressional action, state regulators have an important role to play. Based on SREA's experience with SERTP over the years, it was rare for any state regulatory agency to ever attend SERTP meetings. When we mentioned this lack of regulatory oversight at SERTP, regulators often lamented not having enough time, nor enough qualified staff to engage in the transmission planning forum. While both may be true, it only underscores the importance of having robust stakeholder engagement. Stakeholders can sometimes help fill in the information sharing gaps and alert regulators to contradictory behaviors. State regulators no longer have the luxury of ignoring SERTP or the transmission planning processes of their utilities. The North Carolina Utilities Commission recently pushed for a series of transmission planning reforms. The reformed the North Carolina Transmission Planning Collaborative will soon become the Carolinas Transmission Planning Collaborative. There, the CPTC includes "...the Multi-Value Strategic Transmission (MVST) planning process. The MVST process 1) adopts a forward-looking/ proactive approach, 2) uses a scenario based approach to account for different possible futures, 3) accounts for multiple benefits, 4) avoids line-specific assessments and piecemeal planning, and 5) allows for meaningful stakeholder input into the process." Many of these requirements are based off the FERC proposed transmission planning rule. The process includes a Transmission Advisory Group (TAG) for stakeholders to be engaged. However, if stakeholders propose a scenario that "is more Regional in nature", stakeholders are pointed back to filing a request in SERTP. Individual states can make great strides in improving their own backyard transmission planning rules, but the regional and interregional aspects of transmission planning in the southeast are still entirely dependent on broken SERTP process. To fully fix SERTP, a Multi-Regulatory Strategic Planning Process is needed that includes FERC, Congress, and the State PSC's towards a shared goal of a more robust grid. AuthorSimon Mahan is the Executive Director of the Southern Renewable Energy Association. The Southeastern Energy Exchange Market (SEEM) began public operations on November 9, 2022. SEEM utilities touted it as an “Advanced Bilateral Market Platform” fit for the 21st Century. An early press release stated, “The result will be cost savings while improving the integration of all energy resources, including renewables, which are expanding rapidly in the Southeast, leading to a cleaner, greener, more robust electricity system.” Fans of broader regional market reforms, and opponents to SEEM, called the platform a “nothing burger” noting its paltry benefits. Over the past twelve months, SEEM utilities and opponents have been waiting to see if this experiment is a success or a failure. After a year’s worth of data and operations, it is fair to say that SEEM has not lived up to any of its promises. A Small, Simple Market SEEM participants describe the platform as a simpler, easier, cheaper way to enable power flows across the southeast. Duke Energy and Southern Company have been two lead proponents of the market design. Testimony and analysis filed by the SEEM utilities at the Federal Energy Regulatory Commission (FERC) suggested utilities could save about $45 million annually with SEEM, or about $2/MWh of power traded. That is the same as just $0.002 per kilowatt hour (kWh) of electricity savings. For comparison, the Midcontinent Independent System Operator (a competing market structure) estimates it saved its members over $4 billion in 2022 alone, or nearly 100x more than SEEM was estimated to save. The premise is this: utilities would voluntarily offer extra energy on free transmission for a voluntary price, and if there is a voluntary buyer willing to pay a higher price, those two utilities would “match” and split the savings. SEEM participants provided this example: Southern Company wants to sell 100 megawatts (MW) of power for $50 per megawatt hour (MWh), and if a buyer is willing to purchase at $60/MWh, the two would split the price at $55/MWh and both end up better off than they would have been without the transaction. Below is an example of this sort of power trade. This past year, very little power has been traded using SEEM. In total, 616,398 MWh of power were bought and sold over a twelve-month period. If an average home uses about 12,000 kilowatt hours (12 MWh) per year, the power traded on SEEM equates to about 51,000 homes. For comparison, a large-scale solar facility (300 megawatts) provides enough power for about 55,000 homes per year. Average power prices on SEEM were about $30/MWh, with minimum prices reaching $2.85/MWh in May 2023, and maximum power prices reaching $334.66/MWh in December 2022. A Failed Market SEEM participants touted economic savings by engaging in this new platform. Testimony filed at the Federal Energy Regulatory Commission pegged gross benefits of $47 million annually, with an initial startup cost of $3.8 million, and annual operational costs of about $2.8 million. In a region with over 50 million people, SEEM was projected to save less than $1 per person per year. This past year’s operation has fallen well short of expectations and SEEM may not have saved any money this past year. SEEM does provide some data publicly, but transparency is lacking. Buried deep in the SEEM public data is cell Z4 of the Public Monthly Informational Report spreadsheet, listing a “Total Benefit” value. There are no units, nor further description in any of the monthly Independent Market Auditor reports of what this value fully entails. However, this value likely represents the gross benefits created in the region for each month, given that gross benefits (as opposed to net benefits) are how SEEM’s value was described to FERC. The aggregated Total Benefits for the past year add up to $3.3 million—93% lower than the projected $47 million. If SEEM’s first year costs were $6.6 million ($3.8 million in startup costs, plus $2.8 million in operational costs, as estimated to FERC), and its gross savings were just $3.3 million, SEEM has cost southeastern ratepayers more than it has saved. Without full cost and benefit transparency from the SEEM utilities, these sorts of comparisons will remain difficult. In October 2023, the SEEM Board of Directors met and received an update from the Independent Market Auditor, Bob Sinclair of Potomac Economics. Three items of interest were included. First, “Large percentage of bids and offers are too far apart to clear.” Put another way: utilities are not submitting bids high enough, or offers low enough, for trades to occur. This is an unsurprising outcome, given that each bid and offer is entirely voluntary and not directly tied to specific generation. Next, “To match more efficiently bids need to come up and offers need to come down.” In other words: utilities are stingy when buying and tight-fisted when selling. Finally, “Clearing prices have strong correlation to gas market prices.” Solar is not a price driver. Gas is. The Auditor’s report notes that “The market is not highly liquid”. And “SEEM receives a substantial volume of uneconomic bids and offers that are unlikely to clear.” If the market is not functioning properly, the benefits that were described to FERC in SEEM’s original filings (and hoped for by participating utilities) as justification for the new market evaporate. SEEM is not operating as expected. A Dirty Market When SEEM participants filed their application at FERC, renewable energy was a top selling point. In the testimony provided, analysts stated, “It should be noted that the Southeast EEM can help participants manage periods of excess energy and high net demand ramping created by renewable integration.” SEEM utilities worked hard publicly to support SEEM as a valuable market for solar power generation, even stating, “The SEEM reduces carbon emissions and supports renewable energy integration…” In an alternative market structure like an RTO, power bought and sold is tied to specific generation resources, so buyers can determine exactly the type of resources being purchased. Not so in SEEM: power prices are totally separated from generation type, making it impossible to determine the exact resource mix being traded, or impact on emissions. It was important for SEEM’s branding, at least publicly, to appear to help solar power and reduce emissions. The reality is, of the few trades that have occurred on SEEM, SEEM has mostly been used at night, when solar power is unavailable. Data available on the SEEM website includes Public Hourly Available Transmission Capacity (ATC) Usage. Those data can be used to determine trade quantities and hours. It can also be used to determine which utilities are using the most ATC. Put another way, ATC is a way to measure which utilities are providing their transmission (for free) for electrons to zip across the region. ATC data cannot be used to determine buyers and sellers, nor can it determine generation type. During the night (7PM-7AM), the average Available Transmission Capacity used in each quarter hour was higher than the average used during daylight others (7AM-7PM). The top three hours of average transmission usage were 6AM, 1AM, and 11PM. The bottom three hours of average transmission usage includes 9AM and 8AM. SEEM’s generation mix at night is mostly coal, natural gas, and nuclear power—not solar power. There also appears to be no carbon emission accounting associated with SEEM, meaning the reduction in carbon emissions and support for renewable energy is without supporting data. A Dysfunctional Market Based on the available data, some interesting market strategies appear. For instance, Participant O tends to keep its bids and offers around 10 MWh. Participant E prefers bigger slugs of power: 35 MWh for both bids and offers. Participant T keeps their bids and offers around the 1-2 MWh range. While the quantities are interesting, the pricing tactics are wild. Normal market operations suggest utilities would desire to buy low and sell high, or prices would be close to actual costs. That’s not always the case with SEEM. Participant O’s average bid purchase prices are often around $26/MWh and sale offer prices are around $31/MWh; a fairly tight window of low bids and high offers. Participants F, H, R, and T, on average, are bidding high and sell offers low. This may be an indicator those utilities are relying on SEEM as a market of last resort—as opposed to ramping down generation, sell low, and as opposed to buying longer term contracts, buy high. The stingiest utilities (the ones willing to pay the least for purchases) are Participant I (with an average bid of just $16.5/MWh), Participant B ($19.2/MWh), and Participant A ($22/MWh). If those participants are rational, those utilities must believe that their avoided costs are at least that low, and their generation units are more efficient than every other market participant. They are not seriously interested in buying power. One would expect these utilities to also set the lowest prices for offers, to out-compete their neighbors. But the opposite seems true: Participants I and B offer power for sale at a significant premium compared to their bid prices ($42/MWh and $35/MWh, respectively). The high rollers are Participant R (with an average bid of $50.4/MWh), and Participants K and F (both around $34/MWh). A rational utility that bids high prices is likely very interested in purchasing power and will want to ensure the market makes a match. That may be because their existing generation fleet is relatively expensive, or scarce. One would expect a rational utility to create offers that are close in price to their existing generation (high bids, high offers). Strangely, Participants F and R have their average offers at a significantly lower level than their average bids—they plan to sell very low and buy very high. Participant R on average offers power to be sold at $19/MWh, but average bids for purchase are $50.4/MWh. Meanwhile, Participant M only wants to sell power at an average of $52/MWh, and never put in a bid to buy power. In the study submitted to FERC to support SEEM’s formation, one of the underlying assumptions is that “The study assumes that participants are submitting bids and offers at true costs. The impact of more complex bidding strategies was not accessed [sic].” The actual operational data suggests that utilities are not relying on their true costs to form bids and offers. A Desperate Market Perhaps there are temporal considerations at play—market participants could simply be withholding their bids and offers until a voluntary time that, based on some internal company belief or strategy, provides a value to their companies. During Winter Storm Elliott, when the only utilities in the nation to experience blackouts and rolling load shedding events were SEEM members, SEEM did not help. The Independent Market Auditor’s report from December 2022 showed that from December 24-26, no “matches” (trades) occurred. Offers (sales) almost entirely evaporated. That might not be terribly unusual: the region was struggling to provide power, so few utilities inside the SEEM footprint had “spare” energy to sell neighbors. Outside the SEEM market, MISO helped bail out the southeast by pumping gigawatts of power into the south. The truly bewildering outcome of Winter Storm Elliott was that the total SEEM bids (utilities with the desire to purchase power), plummeted. In a stressed power market, with presumably high-power prices, you would expect the market participants to increase their willingness to buy, and to increase both bid prices and bid quantities submitted. The opposite occurred. SEEM was not useful during Winter Storm Elliott, and the market participants appear to have abandoned it in the most extreme time. Participant O made 77% of the bids from December 24-25. The next most active participant during the storm was Participant G, with just 10% of bids submitted. Participants E, I, and L stopped participating entirely: no bids, no offers. Participant O also submitted the highest bid price of all time for SEEM during Winter Storm Elliott: $4,354.75/MWh. These prices were submitted as a bid at 11AM on December 24, 2022. The next highest bid prices were just $1,175/MWh by Participant K, around the same time. Clearly both of those utilities felt a strong need to boost their bid prices in the hopes of finding spare megawatts. In one aspect, the SEEM utilities determined it was cheaper for the lights to go off than bid higher prices and attract supplies (in the industry, this may be considered a soft version of a Value of Lost Load). No purchases nor sales were made on SEEM on December 24th, despite the high prices and the region’s rolling blackouts. Around that same lunchtime hour, solar power in the region was performing exceptionally well. Bid prices are rarely high in the SEEM market, and similarly bids are rarely below zero. Only Participant A submitted a handful of negative bids this past year, and all in late April 2023. Given that no offers were ever made at a negative price, it is likely impossible these orders ever matched (bid prices must always be higher than offer prices). The lowest offer price was submitted by Participant H: $1/MWh for sale in both February and May 2023 for about 13 MWh to 25MWh at a time. When a utility offers power for nearly free prices in SEEM (or, even below operational costs), it is unclear how its ratepayers are impacted. These costs are obscured in utility rate cases with little to no transparency. A Discriminatory Market Some spectators have noted SEEM appears to be an elaborate public relations effort to discourage real market reform in the southeast, like developing an energy imbalance market (EIM) or a fully developed regional transmission organization (RTO). With minimal benefits, restricted governance, lackluster transparency, and no planning components, SEEM lacks many of the same attributes of a developed market. There is also no venue for state regulatory agencies (Public Service Commissions) to participate in SEEM, unlike RTOs where state regulatory involvement is guaranteed. On July 14, 2023, the DC Court of Appeal s released a decision regarding SEEM: the market is discriminatory. “The creation of a new service that—by its design—excludes existing market participants evokes the discriminatory practices against third party competitors by monopoly utilities that prompted the Commission’s adoption of Order No. 888,” the court said. The Federal Energy Regulatory Commission (FERC) is now required to reinvestigate the value of SEEM and determine if it is “…actually superior to the status quo in light of Order No. 888’s open access principles.” FERC has not acted on the remand order, yet. The future of SEEM is in limbo. The Path Forward Multiple studies have found that the southeast could benefit from broader market reform, like an energy imbalance market (EIM) or a regional transmission organization (RTO). These common-sense market reforms are operational throughout the United States. EIM’s and RTO’s are tried and tested market structures that rely less on highly speculative model results to create benefits. Alternatively, SEEM’s entire foundation was built on an assumption that participants would be active and rational; neither has proven to be true. During Winter Storm Elliott, the southeast relied heavily on neighboring RTOs to help keep our systems afloat. Each year that the southeast waits to determine whether SEEM might live up to its promises is another year of millions of dollars in lost benefits. It is time our state regulators take the reins on SEEM, investigate its operations, and plan for a better system. AuthorSimon Mahan is the Executive Director of the Southern Renewable Energy Association. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed